Loan Calculator

📌 Loan Calculator – Your Ultimate Financial Companion

Easily Calculate Your Loan EMI in Seconds!

Are you planning to take out a loan but unsure about the monthly installments? Managing finances efficiently requires proper planning, and knowing your EMI (Equated Monthly Installment) beforehand is essential. Our Loan Calculator tool is designed to help you make informed decisions by providing instant loan breakdowns, including monthly payments, total interest, and an amortization schedule.

Whether you’re applying for a home loan, personal loan, car loan, or education loan, this tool gives you a clear picture of your repayment schedule. No more complicated calculations—just enter your loan amount, interest rate, and loan term, and get detailed results instantly!

🛠️ How Does the Loan Calculator Work?

Using our Loan Calculator is super easy and requires just three simple inputs:

1️⃣ Loan Amount – Enter the total amount you want to borrow.

2️⃣ Interest Rate (Annual Percentage Rate – APR) – Input the interest rate offered by your bank or lender.

3️⃣ Loan Term (in years) – Specify the number of years you will take to repay the loan.

Once you hit the “Calculate” button, our smart algorithm computes:

✔ Monthly EMI Payment – The fixed amount you need to pay every month.

✔ Total Payment – The total amount you will pay over the loan term (principal + interest).

✔ Total Interest Paid – The extra amount you will pay as interest.

✔ Amortization Schedule – A detailed month-wise breakdown of your principal and interest payments.

🎯 Why Use Our Loan Calculator?

✅ Instant & Accurate Results

Forget the hassle of manual calculations! This tool delivers precise EMI values in just seconds, ensuring you can plan your finances effectively.

✅ Detailed Loan Breakdown

Unlike basic EMI calculators, this tool provides a month-wise amortization schedule, helping you understand how much interest and principal you pay every month.

✅ Free & Easy to Use

No sign-ups, no hidden fees—just a simple and efficient loan calculator accessible anytime you need financial planning assistance.

✅ Works for Multiple Loan Types

This tool is designed for various loan categories, including:

🔹 Home Loans – Plan your housing finance smartly.

🔹 Personal Loans – Understand repayment before taking a personal loan.

🔹 Car Loans – Calculate your vehicle EMI easily.

🔹 Education Loans – Ensure smooth repayment planning for student loans.

✅ Mobile-Friendly & Lightweight

Our Loan Calculator is optimized for all devices, ensuring a seamless experience on smartphones, tablets, and desktops.

📊 Understanding the Loan Breakdown Table

A loan amortization schedule is one of the most valuable insights our tool offers. This table displays:

📅 Month – Tracks each payment month.

💰 Principal Paid – The portion of your EMI that reduces your loan balance.

💵 Interest Paid – The amount paid as interest for that month.

📉 Remaining Balance – The outstanding loan amount after each payment.

Understanding this breakdown allows you to plan prepayments, refinance options, or early loan closures to save on interest!

📝 Example Calculation

Imagine you take a ₹10,00,000 personal loan at 7% annual interest for 5 years.

🔹 Monthly EMI: ₹19,801

🔹 Total Payment (Including Interest): ₹11,88,060

🔹 Total Interest Paid: ₹1,88,060

With the amortization table, you can see how each EMI reduces your principal balance over time, helping you manage repayments better.

🚀 Benefits of Using This Loan Calculator

✔ Saves Time: Get results instantly without complex formulas.

✔ Budget Planning: Know your EMI before applying for a loan.

✔ Compare Loan Options: Test different interest rates & tenures.

✔ Financial Awareness: Understand interest payments & repayment schedules.

✔ User-Friendly: Simple, intuitive, and accessible to all users.

Whether you’re a first-time borrower or an experienced investor, this calculator simplifies loan planning and enhances financial clarity.

📢 Frequently Asked Questions (FAQs)

1️⃣ What is an EMI?

EMI (Equated Monthly Installment) is a fixed amount you pay every month to repay your loan. It includes both principal and interest.

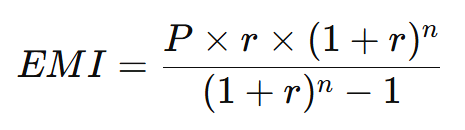

2️⃣ How is EMI calculated?

The EMI formula is

Where:

- P = Loan Amount

- r = Monthly Interest Rate (Annual Interest Rate / 12 / 100)

- n = Total Months

3️⃣ Can I use this calculator for different loan types?

Absolutely! This tool works for home loans, car loans, education loans, and personal loans.

4️⃣ Does this calculator consider processing fees?

No, this calculator only focuses on EMI, interest, and total payment. For processing fees and other charges, consult your lender.

💡 Final Thoughts

The Loan Calculator is a must-have tool for anyone applying for a loan. Whether you are buying a home, financing a car, or covering personal expenses, knowing your monthly payments in advance helps you plan wisely and avoid financial strain.

Start using this smart, free, and reliable loan calculator today and take control of your financial future!